| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: Yesterday, Dr. David Eifrig showed you how to time your entry in one of his top income investments – municipal bonds. Below, you'll find a classic Doc interview that reveals one of the safest, easiest ways to invest in munis – along with just about any trend. He calls it…

One of the Few Legitimate Ways to Make "Free Money" in the MarketBy

Wednesday, November 6, 2013

Stansberry & Associates: Doc, you've called the strategy of buying closed-end funds one of the few legitimate "free money opportunities" in the investment markets. Before we talk about how this idea works, can you first define what a closed-end fund is?

Dr. David Eifrig: Sure. Basically, there are two types of funds available to general investors: open-end funds and closed-end funds. Most of the funds folks are familiar with are open-end funds, like the traditional mutual funds you might own in a 401(k).

"Open-end" means the fund will issue as many shares as investors are willing to buy. When investors put more money into the fund, the fund issues more shares and buys more shares of the underlying stocks. Because of this, the price you pay for one share of an open-end fund will always be the total value of the stocks in the fund divided by the current number of shares outstanding. This value is known as the "net asset value," or NAV. Open-end funds always trade at their NAV.

Closed-end funds work differently. These funds issue a limited number of shares. If you want to buy these shares, you must go into the stock market where they trade like a normal stock. In other words, to buy a closed-end fund, someone else must sell their shares.

As a result, the value of a closed-end fund can fluctuate significantly and does not necessarily reflect its NAV. Any difference between the share price and NAV of a closed-end fund is known as the premium or discount, depending on whether the share price is higher or lower than the NAV.

In theory, this situation makes no sense. Closed-end funds should never trade at a discount, and they certainly shouldn't trade at a premium. After all, it would be foolish to sell a fund for less than it's actually worth... And it definitely makes no sense to buy a fund for more than it's worth.

Of course... in the real world, it does happen. Whether it's because someone has to sell for reasons unrelated to the fund – if they need to raise cash – or folks irrationally selling out of fear, like we saw in 2008 and 2009... closed-end funds will sometimes sell at a significant discount to NAV. This can be a huge opportunity for investors.

S&A: Why is buying these funds at a discount such a great idea?

Doc: It's because under most circumstances, the fund's share price will return to NAV. One of two things is going to happen... Either the market will realize the fund is underpriced and drive the share price up, or the fund managers will get shareholder approval to buy back shares and remove the discount.

Either way, the share price is almost certain to rise. All you have to do is buy it, hold it, and wait.

S&A: How can investors take advantage of these fluctuations in closed-end funds?

Doc: The first step is discovering these situations when they exist. There are a couple great ways to do this.

Barron's publishes a list of closed-end fund valuations. I follow this weekly and you can as well. In the online version, it can be found in "Market Data," under "Stock & Fund Tables." It tracks the net asset values, the discounts or premiums to NAVs, and the 52-week returns.

There's also a great free website you can use. It's www.CEFconnect.com, where the CEF stands for closed-end fund. You can go there and view almost any screen you can imagine. You can sort by fund type, market cap, discount or premium to NAV, and a number of other variables. It's a fantastic resource.

S&A: Do you have any guidelines on when to buy these funds?

Doc: There are no hard and fast rules, but there are a few important points.

First, you need to consider the type of fund. If we're talking about funds that hold bonds or large-cap stocks, I'll get interested when they're trading at 7% or 8% discounts, because those assets are well-traded and highly liquid. On the other hand, if the fund invests in emerging-market stocks or other illiquid or opaquely priced assets, I need to see 12%-15% discounts before I even consider buying.

Occasionally, if you're patient, you'll find incredible situations where funds holding safe, liquid assets are trading at discounts of 10%, 15%, or even more.

A great example here was municipal bonds in 2009. At the time, everyone was talking about the collapse of the municipal-bond market, so investors who held those bonds started selling them en masse, including closed-end funds. So we saw a number of them trading at 15% or 16% discounts.

But when we looked at the facts, we could see the fears were overblown, and the market was offering a huge opportunity. Buying those bonds at a 15% discount was like buying a tax-free dollar for $0.85. And all we had to do was sit and wait for them to return to NAV to make a safe and easy 17%.

Most of these funds hold assets like stocks, bonds, and other funds which are easy to price, so it's relatively easy to determine the NAV. The key is to figure whether there is a legitimate reason for the discount – which is rare – or if the market is simply mispricing the fund. If it's the latter, these are some of the best, safest opportunities available to individual investors.

S&A: When should you sell these funds?

Doc: Again, there are no set rules for selling, but whenever I see a fund go from a significant discount to any type of premium, I start looking to sell.

One thing to consider is whether all the funds in that sector are now trading at a premium or if it's just that particular fund. If it's just the one, I may consider selling it and buying another fund in the same sector that's still trading at a discount. You might be surprised how often that happens.

S&A: Are there any significant risks to buying discounted closed-end funds?

Doc: There are no additional risks to buying these funds, but naturally, they're subject to the same risks as any other investment.

If the stocks, bonds, or other assets in a fund fall in value, the value of the fund could fall, too. Buying these funds at a significant discount provides a degree of additional safety, but it's always possible that funds trading at a discount could go on to trade at an even bigger discount.

There is one additional factor you should consider, though, and that is leverage. Because the market is offering such low yields right now, some funds are using leverage to increase their yields. For example, a fund may invest in bonds yielding 3% and lever 50% of the funds, to increase the yield to 4.5%. Leverage in and of itself is not a problem, but you should avoid funds with excessive leverage. I recommend staying under 30% leverage in any fund.

What's great is you can use the CEFConnect website I mentioned earlier to see exactly how much leverage any fund uses, so it's easy to find the funds you want.

S&A: Sounds great. Any parting thoughts?

Doc: It's funny... I actually remember the first time I heard about closed-end funds. I remember exactly where I was. I was driving in an old '63 Electra, and I was listening to some radio talk show. They started talking about closed-end funds and discounts to NAV, and I literally had to pull over on the side of the road. I had never heard anything like it.

I thought it was such a profound, easy way to make money. Here was a way to buy an asset that's worth $1 for just $0.80 or $0.90, and all you had to do was hold it and wait.

After all these years, it's still one of my favorite strategies. Buying closed-end funds at a discount is one of the few legitimate ways to make nearly risk-free money in the investment markets... It's the closest thing to free money you'll find.

S&A: Thanks for talking with us, Doc.

Doc: You're welcome.

.jpg) UPDATE: Some municipal-bond funds are once again trading at big discounts to NAV. Tomorrow, we'll show you one of Doc's favorite muni-bond funds… and show you how it can help you earn nine times more income than a typical bank account.

Further Reading:

In today's Growth Stock Wire, Doc shows readers a simple "trading for income" strategy using one of the market's most popular income investments. "Like any investment," Doc writes, "you'll do better if you buy the right MLPs at the right time." Get all the details on how to find the right MLPs here.

Market NotesTHINGS CAN'T BE ALL THAT BAD: AIRPLANE EDITION More folks are flying... And that means things can't be all that bad for the world economy.

Over the past few years, we've shown how strength in home improvement stocks, banking stocks, and hotel stocks are all good signs for the health of the economy. As long as these real-world indicators are enjoying booming profits and share prices, the economy can't be in the dumps.

Today, we have another addition to the list: airplanes. Air travel is a good "health gauge" for the economy. When all the middle seats are filled, it's a sign that businesses are busy… and people are vacationing.

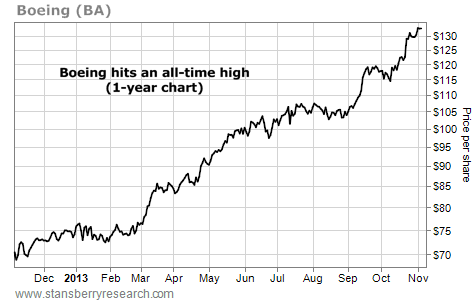

Boeing is the world's largest manufacturer of commercial jets. The company profits as travel increases and global airlines buy more planes. In a recent presentation, Boeing said passenger traffic is healthy. And it just reported a record order backlog. As you can see in the chart below, Boeing's stock has nearly doubled over the past 12 months and shares just hit a new all-time high. Once again, we have to say, "Things can't be all that bad."

|

In The Daily Crux

Recent Articles

|